In the ongoing debate of fintechs vs banks, Fintech has emerged as a disruptive force, knocking on the door of the traditional banking industry and raising new questions for all of us, such as “Which is better for your business: fintechs vs traditional banks?”

We no longer find mobile banking and crypto exchange payments surprising. Yet, the current financial system still relies on outdated processes and practices. Traditional banks, in particular, remain time-consuming and inefficient, creating unnecessary friction.

The latest fintech trends have compelled traditional banks to abandon their conservatism. According to the Financial Brand, 2024 marks a decade since fintech started attracting meaningful venture investment (more than $10B annually).

Traditional banks, on the other hand, are struggling to meet high delivery expectations due to limited data analytic capabilities.

This article will help you decide between fintech vs banks, discover how they can work together, and understand why they should collaborate.

So take out your pencil and start taking notes!

- What is Fintech?

- What are Traditional Banks?

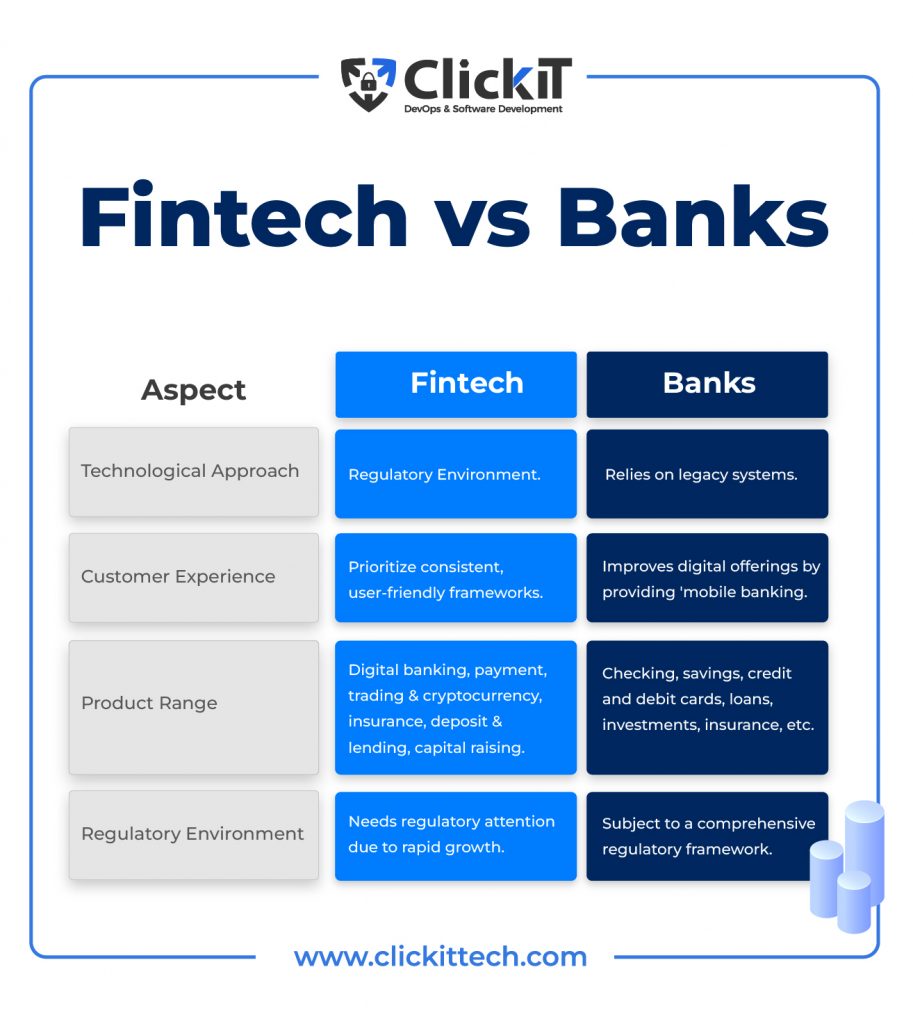

- Fintechs vs Banks: Technological Approach

- Fintechs vs Banks: Customer Experience

- Fintechs vs Banks: Product Range

- Fintechs vs Banks: Regulatory Environment

- Can Fintech Companies and Traditional Banks Work Together?

- How does ClickIT Support your Fintech?

- Conclusion

- FAQs

What is Fintech?

Financial Technology, shortened as FinTech, refers to emerging technologies that enhance and update the requirements of financial services. Business owners, corporations, and consumers use fintech to manage their financial and business activities effortlessly. It executes using algorithms and specialized software running on desktop computers and smartphones. It also involves cryptocurrency development as a part of the banking sector.

Apart from the obvious uses in the financial sector, fintech is spreading its roots into retail banking, education, investment management business, and even charitable organizations. As fintech advances, its focus is increasingly centered around end users.

Fintech contains a variety of tasks that previously required human involvement and are now entirely digital. This includes using a mobile device to deposit checks, manage investments, apply for credit, and any assistance that relies upon technology rather than human intervention. Some of the example use cases are as follows.

- Retail banking

- Investments management

- Fundraising and non-profit endeavors

- Flexible payment options

- Education

- Cryptocurrency

- Peer-to-peer money transfer

With the rise of mobile banking, decentralized access, and accurate analytics, opportunities have emerged for consumers, B2B customers, and B2C customers who are increasingly interested in fintech services.

Even traditional banking institutions have begun procuring fintech startups, embracing digital prowess.

What are the Benefits of Fintech?

Fintech can benefit both consumers and businesses in a number of ways, including.

- Ease of service and comfort: Through fintech, you can pay your bills, make direct deposits, encourage bank transfers, or find the answer to your question immediately through chatbot technology.

- Accessibility: Fintech provides credentials to people living in isolated areas or who have disabilities. Now, they can quickly opt for financial transactions and services that were not offered earlier.

- Security: Fintech provides additional security actions to save people from defrauding activity.

- Savings: Fintech apps enable users to save money by linking their credit card accounts with their bank accounts.

What are Traditional Banks?

Banks are typically licensed financial organizations that accept deposits, grant loans, and offer other financial services to customers. It includes safe deposits, money management, and currency exchange. They can be further classified into corporate banks, retail banks, and investment banks. However, bank operations are limited due to the need to visit bank branches.

Government and central bank regulations are usually in the control of banks. Therefore, this leads to the blocking of capital and low profitability. In the conversation of Fintech vs traditional banking, Fintech is now targeting the limitations of banks by delivering outstanding services to customers.

What are the Benefits of Banks?

Traditional banks have the following advantages:

- Being able to visit a nearby branch and speak with a staff member.

- Positive impact on client and supplier perceptions, which develops trust.

- Personalized service.

- Making cash payments and withdrawals easier.

- More financial products are accessible.

Fintechs vs Banks: Technological Approach

How is fintech supposed to be different from banks? Here are some of the main differences of fintechs vs traditional banks.

FinTech emphasis on leveraging technology.

Fintech and Banks are both registered to supply financial services to consumers. In other words, fintech companies are supposed to be competitors to conventional banks. The distinction is that fintech companies use new technology, while traditional banks are hesitant due to their outdated legacy infrastructure. Such legacy systems are limited in their ability to establish an interface with another system, thus slowing down the whole process.

Fintech, in contrast, is unaffected by these legacy systems. Instead, it leverages the latest technologies, such as

- cloud computing

- machine learning

- artificial intelligence

- big data

These technologies enable fintech firms to provide a frictionless experience to consumers when compared to the tools offered by traditional banking institutions.

Fintech offers a wide range of digital applications.

Today, various categories of fintech companies are available. It ranges from digital platforms and mobile banking applications to blockchain-based cryptocurrencies. They are a digital-first approach to providing financial services that offer

- Secure payments,

- Greater convenience,

- And personalized service to consumers.

In contrast, what are banks’ challenges to adopting new technologies? Bellow are the encounters that banks need to overcome to be a part of the wide range of digital applications.

- Reluctance to change legacy culture mindset.

- Employees are incompetent in using new technology.

- Cost and availability for the purchase of new equipment and technology.

- The speed of technology is making it very difficult to stay up.

- The strategy for new technology implementation is ineffective or nonexistent.

Fintech is Agile and adaptable to technological advancements.

Fintech is Agile and adaptable to technological advancements, making it well-suited for remote work environments.

Post-pandemic, there has been a sudden growth in the banking and fintech sector. Traditional banks began offering online credit card services and other utility services, while fintechs emerged around the world. Nowadays, both firms need to adopt authentic technology faster than ever while ensuring quality and safety.

Agile is a very effective approach to developing software for its ability to integrate with existing systems. Moreover, fintech is known for its agile behavior that quickly adapts to technological advancements.

In contrast, traditional banks rely on physical branches and personal interactions between customers and bank staff members. Digital banks challenge this model by offering financial services online and eliminating physical branches. As a result, traditional banks are being forced to strike a balance between traditional and digital infrastructure.

Fintechs vs Banks: Customer Experience

Fintech focuses on a flawless and user-friendly experience

Fintechs prioritize consistent and user-friendly frameworks that provide simple, easy-to-use access to financial services.

The main highlight is to build a platform that would be easy and simple for your customers, preventing any single point of failure. It also confirms that your app or platform is optimized for different screen sizes, no matter how old or new the smartphone is.

On the other hand, banks improve digital offerings by providing ‘mobile banking‘. This offers services such as account balance inquiries, money transfers, payment of bills, and conducting transactions through the Internet and mobile phones. Said digital tools are helpful, but they pale and still have limitations compared to the framework adopted by fintech firms.

Convenient and accessible financial services

Financial services are today more convenient, accessible, efficient, and affordable than ever before. Thanks to the development of digital platforms and advancements, fintech transforms the financial services market network and develops new prospects for businesses and consumers.

When talking about traditional banking vs fintech, in the first one customers have to follow red tape (bureaucracy) to set up and maintain their banking accounts. While in the second one, doesn’t apply this way. This situation is exposed with activities like:

- Paperwork (filling out forms to provide personal details)

- Personal visit to the nearest bank branches in person (for any particular banking services)

- Pay slips

Even though they are designed to help keep everyone on track, bureaucracies are often criticized for being clumsy and emphasizing process and policy over efficiency. Bureaucracies aren’t going away, no matter how you feel about them-positive or negative. They are a part of the process of many banks.

Fintech based on personalized solutions through data-driven insights

Data is essential for fintech companies as it allows them to gain insights into customer behavior & preferences, detect and prevent fraud, and monitor & mitigate risk. Furthermore, data analytics is necessary for fintech companies to remain competitive in a dynamic environment.

Fortunately, data analytics explores both structured and unstructured data from various sources. This includes transaction data and customer profiles so that fintech companies can better understand their customers and offer tailored services and products.

Conversely, how are banks sensitive to potential gaps in meeting customer expectations?

Check out the following reasons:

- Not serving personalized recommendations and services based on individual needs and preferences.

- Painful online banking platform while doing transactions due to some errors or server issues.

- Not user-friendly interfaces

- No regular updates to improve the digital banking experience etc.

Read our blog on how to build a Fintech app; or continue reading to know more about fintech vs traditional banks.

Fintechs vs Banks: Product Range

Fintech expertise in specific areas of finance

Fintech is a business technology model that innovates in the financial sector to improve its use and delivery of financial services to customers. Its core specialization in certain areas of finance covers:

- Digital banking

- Payment

- Trading & Cryptocurrency

- Insurance

- Deposit & lending

- Capital raising

These specific areas can bounce the following:

- Disrupt the present industry structure and boundaries

- Establish a strategic mediation facility

- revolutionize the way companies generate and deliver products and services

- Provide significant privacy protection

- Law Enforcement & Regulation Challenge

- Create new avenues for entrepreneurship

- Plant the seeds of inclusive Growth

Robo-advisors, digital payments, peer-to-peer (P2P) lending applications, investment apps, and crypto apps are instances of fintech applications. Anyone with a smartphone can download an app and get professional investment guidance with minimal human involvement and surprisingly low fees.

In the fintech vs traditional banks debate, fintechs are increasingly considering expanding into broader financial services in order to unbundle offerings to firms and generate new markets for them.

On the other hand, a bank or financial organization provides products and services to its customers. It offers a wide range of financial products & services, including:

- Checking current and savings accounts

- Credit and debit cards

- Loans, such as mortgages & auto loans

- Investment outcomes such as mutual funds and stocks

- Insurance products

- Online and mobile banking services

- Foreign currency exchange

- Wire transfer and direct deposit services

These products and services help customers to manage their money and reach their financial plans.

Potential partnerships with fintech companies for innovation

Banks are currently embracing Fintech technologies to improve the user experience and fulfill the customer’s technological needs. Developing a sector for the digital future by combining innovation (fintech) and trust (banks) is a win-win situation. In addition, the partnership would assist banks in regaining skills they had lost earlier and acquiring new skills.

The following are the most often cited reasons for the best tech companies to partner with fintech.

- Growth in loan volume and loan productivity

- Development of new product

- Enhancing deposit account opening productivity

Of course, these collaborations are not always successful and might result in financial and time losses. But one thing is sure: collaborating with fintech gives access to innovative technologies, faster and more advanced innovations.

Fintechs vs Banks: Regulatory Environment

Fintechs need regulatory attention due to rapid growth

The rapid development of fintech services and the increasing use of technologies also bring risks, that’s so that in Fintech vs Traditional Banking, Fintech companies do not have specific regulations. That is one of the most important reasons why huge fintech startups are starting to emerge.

Since they do not follow strict guidelines, startups are free to make changes in their business. Therefore, it is easy to adapt to the needs of their customers and provide customized solutions. This is actually a risk, too.

One of the main regulatory challenges for fintech is keeping up with Know-Your-Customer and Anti-Money-Laundering regulations. Fintechs must comply with these rules to protect consumer and data privacy and prevent money laundering.

Several regulatory authorities have embraced a revived ‘regulatory sandbox’ model to protect customer privacy. It is a collaboration between fintech and regulators that allows eligible applicants to test their technology-enabled financial application for a specified period.

Sandboxes are characterized by providing regulatory guidance and play an important role in promoting entrepreneurial and innovative activity among Fintechs.

Bank regulation is a comprehensive regulatory framework aimed at promoting safe and well-managed banking. Its primary objective is to safeguard consumers’ data, assure the financial system’s serenity, and prevent monetary crime. In addition, it emphasizes considerations of systemic importance and stability by ensuring customers have access to information about their rights and choices.

For example, regulations may include

- Ban any fee or limit the interest rates that banks can charge on loans.

- Promoting competition that keeps prices low for consumers and fostering innovation in the banking sector.

Furthermore, bank regulators also monitor the activities of banks and enforce regulatory compliance. By doing so, bank regulators guarantee that banks operate safely and well and that consumers are protected from fraud and abuse.

Fintechs vs Traditional Banks: Risk Factors

Fintechs and traditional banks navigate unique landscapes with distinct risks and challenges.

Fintechs leverage technology to deliver efficient financial services but face regulatory uncertainty and cyber threats. Traditional banks face compliance burdens and market risks, but offer stability and trustworthiness.

Howeever, Fintech offers advantages over traditional banks such as resilience, cost-effectiveness, superior user experience, and an innovative approach, making it a preferred choice despite higher risks. Traditional financial institutions must embrace financial technology to stay competitive, enhance user services, and expand outreach with top-notch services even with their legacy systems.

Can Fintech Companies and Traditional Banks Work Together?

Now that we have clear the key differences between fintechs vs banks, let’s answers an important questions that users have: Can Fintech and Traditional Banks Work Together?

Well, believe it or not, yes, of course, they can, and a perfect example is that Fintech companies collaborate with traditional banks, providing services such as Regtech (Regulatory Technologies) to facilitate banks’ compliance with regulations and Paytech to enhance customer experiences.

Fintech companies often bring innovation, agility, and specialized expertise in areas like digital payments, lending, and personal finance management. On the other hand, traditional banks possess established customer bases, regulatory experience, and robust infrastructure. By joining forces, they can leverage each other’s strengths to deliver enhanced services and products to customers, so the relationship between fintech vs traditional banks can lead more towards collaboration rather than competition.

How does ClickIT Support your Fintech?

ClickIT is a leading provider of software development in Latin America. It offers comprehensive services in web development, mobile apps, and product design. In addition, the business has won awards for its exceptional services and outstanding work.

Their proficiency in developing Fintech applications is unmatched. It has numerous advantages, including the following:

- It provides an affordable and cost-effective solution without compromising on its quality.

- They specialize in migrating on-site workloads to the cloud.

- Skilled teams have a solid understanding of their project, which enables them to implement solutions that meet customer needs.

- Deliver highly scalable products on time.

- Advanced security recommendations.

Conclusion

As seen in this article, deciding between Banks and Fintech is difficult. It’s tough to declare a winner in the Fintech vs Traditional Banking debate, as both systems have substantial advantages. Yet, the world is technologically changing and updating on a daily basis, with new technologies entering the market.

Fintech has arisen as the best choice available in the market. It enables people to access all financial facilities through their smartphones anytime and anywhere.

Ultimately, the “better” option depends on your specific requirements, preferences, and the specific services you need. Some individuals may find fintech more suitable due to its convenience and innovation, while others may prefer the familiarity and comprehensive services of traditional banks.

Visit ClickIT to develop your Fintech application with us.

FAQs

Many fintech platforms offer a lean operational model that defines fintech startups and provides customized financial solutions as per the needs of their customers, which is not allowed in banks.

Banks are likely to adapt to these by improving their customer experience and offering services such as remote account opening and artificial intelligence that work with legacy infrastructure.

This can save banks and fintech providers money and time while controlling scams and cyber attacks. The fintech industry uses machine learning in a number of ways, including preventing cyber attacks, stock/investment data analysis, chatbots-based client service, and stopping financial fraud.

Both systems have substantial advantages. Yet, Fintech, now accounting for only a 2% share of international financial services income, is calculated to generate $1.5 trillion in revenue yearly by 2030.

FinTech utilizes cutting-edge technology for innovative financial services, while traditional banking relies on legacy systems.